Investigating the Advantages of Payout API in Particular Industries :

Introduction:

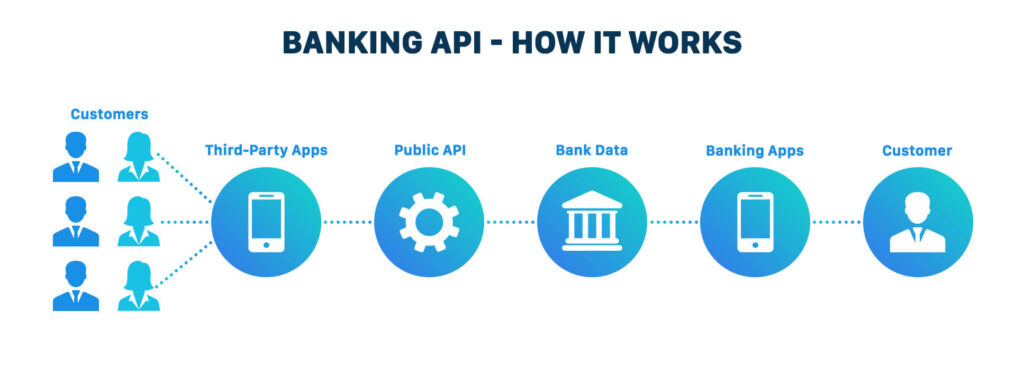

Businesses

from a range of industries are adopting cutting-edge technologies to streamline

their financial transactions in the new digital landscape. The Payout API

(Application Programming Interface) is one such technology that offers a strong

solution for automating and expediting payments. Gig economy platforms,

e-commerce, and marketplaces, travel and hospitality, insurance companies,

online lending and fintech, as well as digital wallets and payment service

providers, are just a few of the businesses we will examine in depth in this

blog article. We will look at how companies in various sectors may use the

Payout API to increase operational effectiveness, improve consumer experiences,

and address issues unique to their respective markets.

A platform for the gig economy

Gig

Economy Platforms run on a broad network of service providers or contractors,

including ride-sharing platforms, freelance marketplaces, and food delivery

applications. Whether disbursing salaries, vendor payments, or batch payments,

the Payout API is essential in enabling smooth and prompt payments to these

people.

Benefits :

- Platforms

for the gig economy can automate payment procedures by using the Payout

API.

- ensuring

prompt and accurate payments.

- enhances

operational effectiveness

- lowers

the administrative burden

- increases

the overall satisfaction of service providers

- resulting

in improved satisfaction and stronger relationships.

E-commerce and Marketplaces:

Online

marketplaces and e-commerce companies sometimes struggle with managing numerous

payment transactions involving vendors, affiliates, and sellers. By automating

intricate payment networks including vendor settlements, affiliate revenues,

bill payments, and batch payments, the Payout API provides a comprehensive

solution. It makes it possible for companies to efficiently handle a lot of

payments.

Benefits

:

- E-commerce

enterprises can streamline payment procedures by utilizing the Payout API.

- minimizing

human error

- strengthen

connections with merchants and partners

- improving

the general client experience.

Travel and Hospitality:

Payment

transactions in the tourism and hospitality sectors include hotel reservations,

commissions paid to travel agencies, and affiliate relationships. The Payout

API makes it easier to send money to hotels, travel agencies, and other

businesses while ensuring prompt and accurate payouts. Whether managing batch

payments, bill payments, or payments to vendors.

Benefits

:

Travel

and hospitality firms can optimize payment procedures by integrating the Payout

API.

- lessen

the costs of administration

- Ensure

that partners and customers have a seamless payment experience.

- increases

effectiveness

- increases

client happiness within the industry and builds trust.

Online Lending and FinTech:

The

difficulty of arranging loan disbursements, repayments, and interest payouts to

borrowers and investors is an issue for the lending sector, particularly

peer-to-peer lending platforms and online lenders. By automating these

procedures, the Payout API provides a strong solution, ensuring quick payment

transfers and precise accounting. Whether it’s managing interest payments,

processing repayments, or coordinating loan disbursements.

Benefits :

The Payout

API integration helps online lending platforms to increase operational

effectiveness.

- lessen

the possibility of human mistake

- enhances

the experience of investors and borrowers overall

- Increases

trust and quickens financial transactions

- encourages

the expansion of the FinTech and lending industries.